More Data Tracking, Fewer Data Headaches

Senor Check Cashing is a chain of community financial centers in Texas.

Their customers largely belong to the non-banked and under-banked community, and their services span everything from check cashing and money orders to bill payments and prepaid debit cards.

After years of struggling to collect data from each location, Senor Check Cashing hit a wall and knew they needed to approach it from a new direction. A long journey through various software alternatives led them to try Knack, and they built a system that finally enabled them to share data across retail locations and back to their corporate back office.

Not only did this save them thousands of dollars, it also allowed them to branch out into new services and better serve their customers — all while ensuring their sensitive financial data is organized, accounted for, and secure.

It felt too good to be true. This thing’s bulletproof.

A Problem in Need of a Solution

When Sean Qureshi joined Senor Check Cashing in 2013, he had a lot on his plate. The company was fairly small, with nine locations. But each of those locations had its own style, so managing operations was difficult.

Sean is Senor Check Cashing’s Chief Operations Officer, so it’s his job to monitor and maintain the systems, policies, and procedures of company operations from the retail level to the corporate level. He realized he didn’t have the data he needed to properly do this work, and problems were beginning to arise.

For example, as a result of internal disorganization, the company wasn’t able to control their customers’ debt. When checks bounced, it was difficult for senior management to trace the shortcomings in the collection process, because that information wasn’t being shared properly.

The Senor Check Cashing team hard at work.

Though out-of-the-box applications do exist for debt collection, Senor Check Cashing’s situation was a bit unique, due in part to the wide range of other services the company offers. Trying to make one of those inflexible solutions work proved too much of a hassle.

Sean and the team decided to hire programmers to develop a custom solution. After spending around $12,000 just to get it launched, they later tried to expand it only to see their developers increase their contract from $100 to $8100 per month, and it still wasn’t solving all of their problems.

The lack of a solid data solution was increasingly affecting Senor Check Cashing’s data integrity and their day-to-day operations. It was clear to Sean that something needed to change.

This framework allowed me to create an application with little to no training required for my end users.

A New Direction

After having gone through a build from the ground up, Sean was more sure of what he needed. That’s when he found Knack. When he first proposed the idea to management, it was immediately dismissed. His boss wasn’t enthusiastic about starting over from scratch — “reinventing the wheel,” as he put it.

Sean and the team were jaded after their previous experience, but after taking another look at Knack, he decided it was too appealing to pass up, and he started to work on it in his spare time after work. “It just looked easy from the videos you had online, so I just wanted to try my hand at it,” he explained.

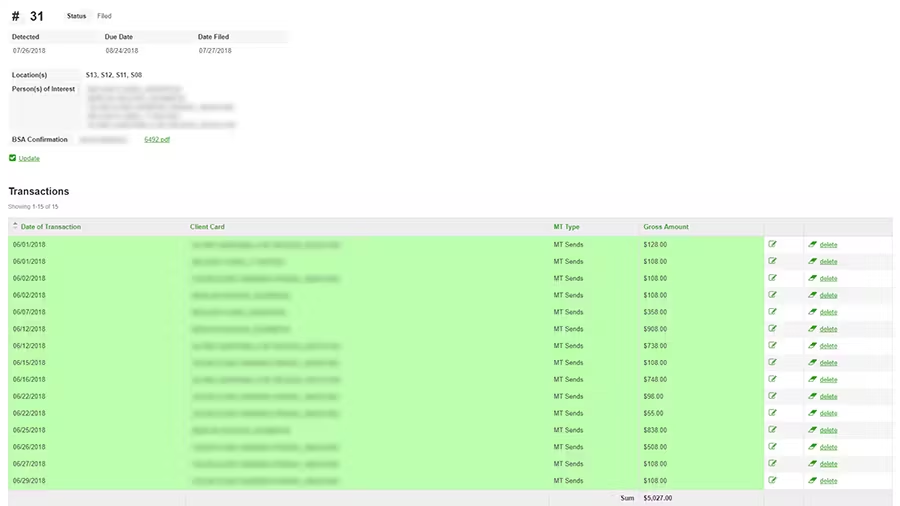

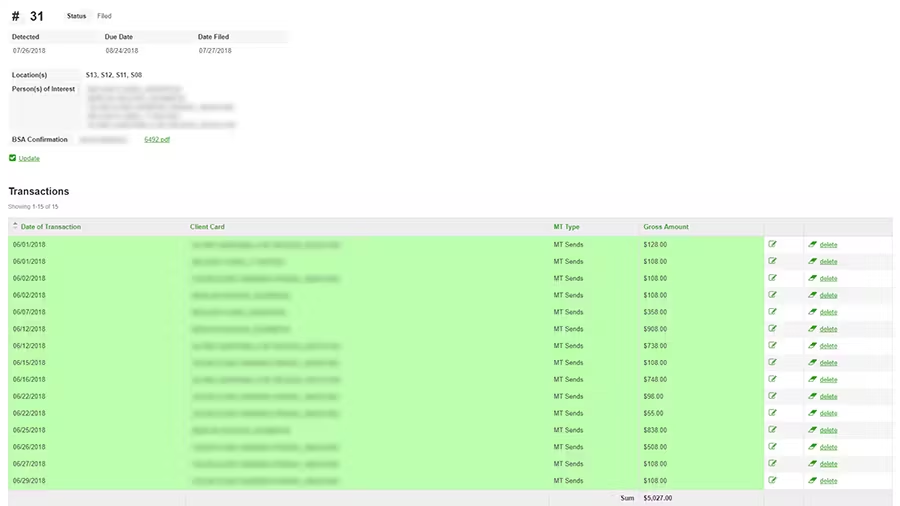

Senor Check Cashing tracks every customer transaction for up-to-date, line-by-line account details.

Soon he had an app that worked and looked great. His team was thoroughly impressed. Sean’s boss hadn’t wanted to invest in another fully custom built database that could cost tens of thousands of dollars, but he still had big ideas. Once he saw Knack, it was clear it could solve their data problems while still being affordable. It was a perfect fit.

“I was amazed by how easy Knack made creating a database, and I was even more impressed with how intuitive the user side of the applications was,” Sean said. “This framework allowed me to create an application with little to no training required for my end users.”

If someone owes money at one location, we’ll know right away when they visit another store; they can’t slip through anymore because everything’s centralized.

No More Slipping Through the Cracks

Integrating Knack into their existing stores was a critical operation. They had thousands of dollars along with their customer’s trust on the line. They had to have complete confidence that the system they build with Knack would be 100% accurate.

“I needed something that I could trust as far as calculations go,” Sean explained. “It’s a matter of money, so if there’s a mistake in our program, that’s going to cost us real dollars.”

They started by implementing Knack at two or three stores for about a month. Sean carefully observed and verified that data, and once Sean was confident it would work, they went ahead and expanded use to all locations.

Even then, “it felt too good to be true”, so they ran a dual system for about a year to further add to their confidence. Seeing Knack accurately handle their data was crucial for building trust in the system and becoming 100% confident: “I finally said: this thing’s bulletproof. We can go with this.”

All departments use Knack apps to provide financial services and track customer details.

They are now able to track the collection process from start to finish. Whatever service a customer is interested in, their data goes into Knack. Check cashing, bill payments, money transfers, money orders, prepaid debit cards — every interaction is entered into the app and connected to the customer.

This allows for an expansive transaction history and prevents duplicate customer records. Because they now have a higher level view, they’re also able to recognize commonalities among bad debt accounts to reduce their exposure to that kind of behavior.

“We’re able to throw a net out on the whole city,” Sean explained. “If someone owes money at one location, we’ll know right away when they visit another store; they can’t slip through anymore because everything’s centralized.”

Once, one of their accounts was short almost $40,000. It’s hard to predict how much cash a store will need, but sometimes there’s a large influx and money needs to be moved around. “It’s a big tornado of confusion, and things can get overlooked,” Sean said.

Thanks to Knack, all that data is entered and tracked from the start. “Being able to have these records and view their history makes it so easy,” Sean said. While his employees were running around trying to figure out where the money was, “It only took me a few minutes to look up the record history and match that against our bank records. Boom — that would’ve taken a week before.”

Knack has my back. It’s like an Excel sheet on steroids.

Even Better than Expected

Not only has Knack improved their data, it’s also improved their operation. Implementing their Knack app across all retail stores allowed Senor Check Cashing to take the best practices from successful stores and make them uniform company-wide. Being able to see who made changes is likewise valuable, so when mistakes are made, they can be traced and employees can be retrained as needed.

“Our benefits have superseded the original scope,” Sean said. The team is now able to forecast cash and place orders centrally, vastly reducing the time on the front line with tasks that have been automated. They’ve also been able to reduce payroll hours by more accurately allocating hours on the schedule.

Knack has allowed Senor Check Cashing to expand beyond financial services, and they now also provide insurance.

“When IRS auditors visit us to audit our compliance with Anti-Money Laundering and Counter Terrorist Financing programs, they are impressed with the metrics we are able to collect, as well as the organization of the information for their reference,” he added. “This has made our audits much smoother and has relieved the worries and headaches associated with such examinations.”

In 2017, Sean calculated that Senor Check Cashing had saved over $50,000 dollars in decreased labor costs — money they can now allocate to other tasks.

At 32 locations, their legacy system would have cost $16,000 dollars a month and $192,000 a year. After factoring in the costs associated with maintaining the database along with hosting, with Knack they’re saving nearly $150,000 dollars annually.

The question isn’t what else can I do with Knack. The question is: what can’t I do? Because whatever I think up, I know Knack can help.

No End in Sight

Because they’re now able to control and manage all locations centrally with the Knack app, they have also been able to expand from 9 locations to 32, across 3 different cities. Knack has also helped the company expand in ways beyond organization and data security.

They’ve recently opened an insurance side of the business, where they offer auto, home, liability, and life insurance. That’ll soon be integrated into Knack, with a client-side login so customers can track their insurance and its benefits.

Before Knack, insurance wasn’t even on the radar for Senor Check Cashing. But thanks to the time and energy saved, Sean’s employer found himself with more resources to devote to growth opportunities. “Once you’re able to control something, you end up finding yourself with a lot more time, and you’ve got to make use of that time, so you get into other things,” Sean explained.

Sean chats with Knacksters Danielle and Jessie at a Knack Meetup in Austin.

And that growth is open-ended, as the team is constantly finding new ways to use Knack. “I get calls all the time — ‘Hey, can we do this?'” he said. “Knack has my back. It’s like an Excel sheet on steroids.”

If he hadn’t come across Knack when he did, Senor Check Cashing would probably look very different today. “There’s this image out there of going from a small company to a larger company. You see other companies, and you tell yourself — well, they’re huge companies, that’s why they’re able to do some of those things,” Sean explained. “I think we would’ve just bought that idea that we’re not big enough to have the data in the way that we need.”

Now, there’s no uncertainty as to whether they can accomplish what they set out to do. “The question isn’t what else can I do with Knack,” Sean said. “The question is: what can’t I do? Because whatever I think up, I know Knack can help.”